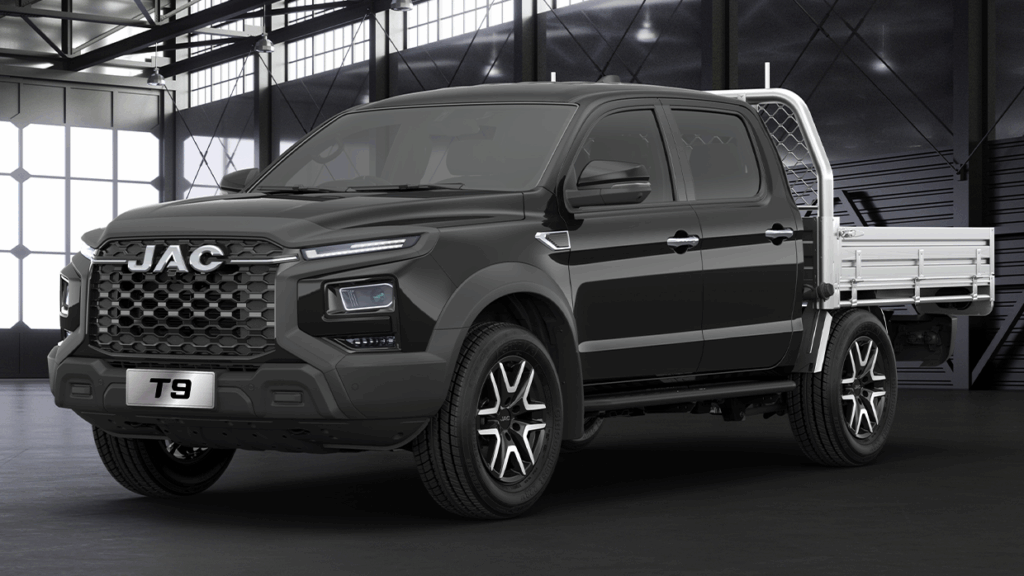

JAC T9 2026: Newcomer Chinese ute expands offerings with new range-topper and cab-chassis to battle affordable LDV T60, GWM Cannon, and KGM Musso rivals

Two new crew cabs and flagship Osprey trim grade to join the JAC T9 dual-cab ute family imminently

New-kid Chinese specialty ute brand JAC has confirmed it will expand the local range of its sole T9 dual-cab model with the introduction of a range-topping Osprey grade and two trim levels of an all-new cab-chassis body.

The cab-chassis body, a first for JAC, will keep the four door dual-cab body seen on existing T9 models, but will replace its conventional tub with a flat alloy tray, which JAC says can support a payload of 1165kg (excluding the weight of the tray).

So far, JAC has confirmed two model variants of T9 cab-chassis; the base Tradepro and once-base Oasis, which remains the lowest specification for tub-trayed T9 models.

It is unclear whether the flat tray, pictured in JAC’s marketing material, is included with the T9 cab-chassis, with JAC pitching the body as a ‘blank canvas’ ideal for a fitout of ‘a service body, custom toolboxes, or a specialised equipment’ fitout.

Introducing more variety to the T9 model range will no doubt drive sales of the model, particularly in the fleet market, helping the dual-cab newcomer to find a footing against a constantly growing list of cheap rivals.

That growing list is headlined by China’s $45,253 LDV T60, $34,490 GWM Cannon, and soon-to-launch $39,990 Foton Tunland, while Korea offers a cut-price KGM Musso for $40,140. All prices listed are before on-road costs.

To add fuel to the fire, JAC is additionally offering reduced-price drive-away deals on its current MY24 stock of Oasis and Haven T9s up to October 31st. Those models have been dropped from $42,662 and $45,630 before on-roads to $39,990 and $43,990 drive-away, respectively.

Meanwhile, at the other end of the scale, JAC’s new Osprey grade adds additional equipment over the once flagship T9 Haven. Predominant enhancements include a power sunroof and a ‘premium suspension tune’ – what that entails is not yet known.

Optioning further to the Osprey X will additionally add blacked-out features on its exterior, darkening the style of the front badge, wheels, roof bars, wing mirrors, door handles and side-vent surrounds.

Premium, yet affordable, rivals to the T9 Osprey include the soon-to-release $52,990 MG U9, $53,674 LDV Terron 9, and the quirky $64,900 Deepal E07 Multitruck.

JAC claims the Osprey’s 980kg payload limit has been intentionally engineered to keep it below the one-tonne novated leasing ceiling – a critical element for enticing fleet buyers.

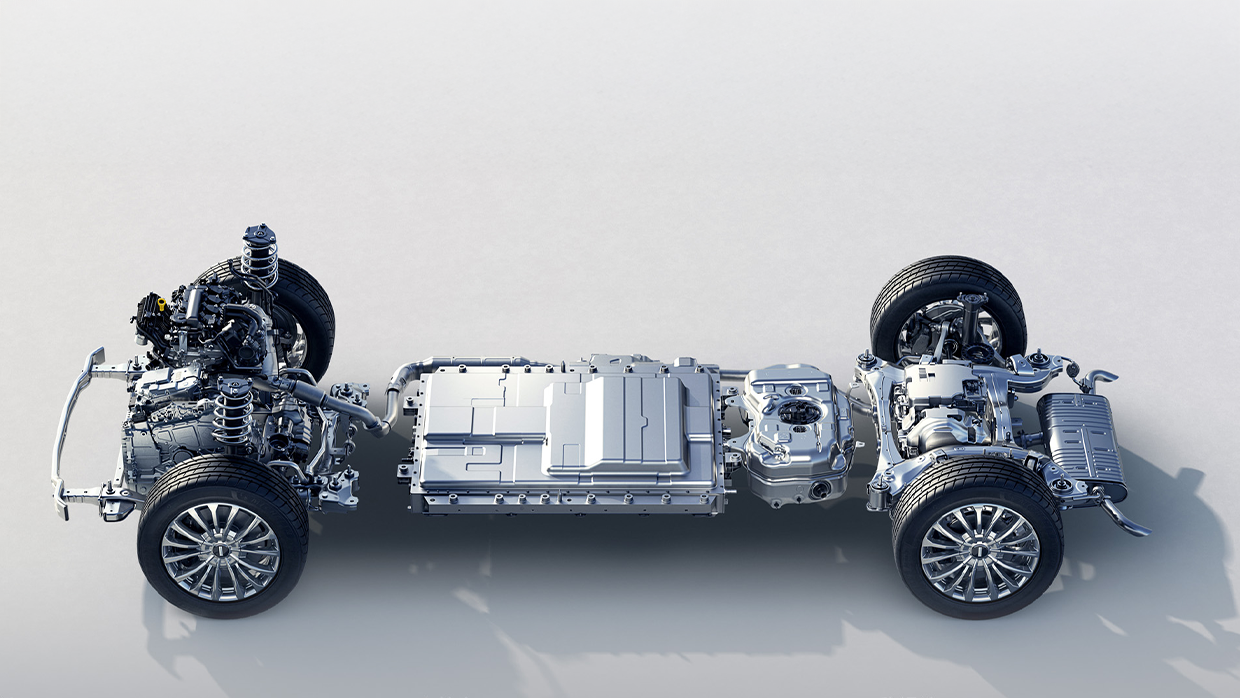

Regardless of trim level or body, all T9 models will continue to be powered by a125kW/410Nm 2.0-litre turbo-diesel four-cylinder engine mated to a conventional eight-speed automatic and competent four-wheel-drive system.

Pricing and further specifications for both cab-chassis T9 models, as well as the range topping tub-trayed Osprey grade, are yet to be revealed. JAC claims these details will be revealed closer to the launch date of the models, which is one month away.

New 2026 GWM models coming to Australia: Haval, Ora, Wey product offensive unleashed!

2 days ago

New Wey sub-brand to lead 2026 releases, but Haval, Ora, Tank and Cannon expected to receive attention next year

Having launched seven new products this year, GWM is ready to do it all again — confirming that it will launch “at least” seven more new models in Australia in 2026 across its five sub-brands.

GWM’s multi-brand showrooms are set to become so chocker-block with new metal that the Chinese conglomerate is seeking to convince dealers to join a new “Rise” program that will see retailers and GWM co-invest in larger retail sites.

Only by joining “Rise” will GWM dealers be allowed to sell at least two new models that will come to Australia in 2026 under the new Wey luxury sub-brand, with the Wey G9 minivan and Wey Blue Mountain large SUV locked and loaded for a local release.

Wey luxury sub-brand to bring two PHEV models to Australia

“We are going to launch the Wey brand, which is very much tied into what we need to do about our brand,” GWM Australia chief operating officer John Kett told media including Chasing Cars.

“There will be certain conditions under which dealers will get access to the Wey brand. Rise is a project where the dealers need to invest in larger stores, so we can really showcase all of our brands and our portfolio.”

Both the Wey G9 and Wey Blue Mountain use a similar all-wheel drive 1.5-litre turbo petrol plug-in hybrid (PHEV) powertrain with 358kW and 380kW of power respectively. Both are expected to be priced under $100,000.

“We see PHEVs as being the battleground in [Australia] over the coming years. If we can win with that tech, that allows us to keep petrol and diesel going for longer,” said GWM Australia head of marketing Steve Maciver.

New PHEVs plus first EV option planned for Haval SUV range

The Haval brand will be revitalised in different ways in 2026. While not a new model launch, GWM’s best-seller — the Haval H6 midsize SUV — will benefit from a comprehensive Australian suspension/steering retune early next year.

“We have just launched the H6 [facelift] as a PHEV, and the new next-generation H7 will also be a [PHEV],” said Kett.

Alongside the next-gen H7, which is expected for launch in 2026, Kett also confirmed that Haval will expand the Jolion small SUV lineup with the Jolion Pro — a new model that will provide PHEV and, in a first for Haval, a full battery electric (BEV) version.

But Haval is expected to again miss a large three-row SUV option in 2026. A plan for the Wey Blue Mountain to wear Haval badges locally has been abandoned in favour of positioning that crossover in premium territory.

Tank 500, Cannon Alpha to get bigger pure-diesel engine option

The low-CO2 Wey luxury PHEV models will help GWM attain emissions credits under Australia’s New Vehicle Efficiency Standard (NVES) regime under which pure petrol/diesel vehicles are penalised.

Those credits will backstop GWM’s planned rollout of a new 3.0-litre turbo diesel four-cylinder engine for the Tank 500 large 4WD and Cannon Alpha large ute in 2026. Both of those models are now available with a PHEV alternative, giving buyers powertrain options.

GWM is also working on two other pure internal combustion projects, but they are expected for launch in 2027.

One is a new super-capable, top-tier 4WD model that has been confirmed to be pure ICE, while GWM is also developing a 4.0-litre petrol V8 engine that has been tested in the Tank 300.

Ora EV sub-brand expanding into small and possibly midsize SUVs

GWM’s hitherto smallest sub-brand, Ora, started life as a BEV-only specialist and in Australia, it presently offers only the eponymous “Ora” small hatchback — one of the country’s cheapest BEVs and a vehicle that is regularly discounted.

But while GWM Australia has pivoted to concentrate on PHEVs — which are compliant under NVES laws and seen as more immediately palatable to local buyers — Ora’s BEV lineup will be expanded with one or two models, this time SUVs.

“In the small SUV segment, we will certainly have an Ora SUV next year,” Kett said. “We are still considering a midsize SUV coming out of the Ora lineup.”

That small SUV will be the GWM Ora 5, which is similar in size to the BYD Atto 3. Battery sizes and driving range is not yet known but is expected to sit around 500km (WLTP).

The forthcoming midsize Ora SUV has not yet been revealed — but it is expected to offer both BEV and PHEV powertrain options with GWM global chief technology officer Nicole Wu revealing to Australian media that Ora will pivot away from solely focussing on BEVs.

“When we launched the Ora brand, a lot of customers gave feedback to us that they loved the size, convenience and styling, but [that] they don’t want a BEV — they want hybrid or PHEV,” Wu said.